CPD EVENTS

- This event has passed.

INTRODUCTION

Malaysia like other developing countries offer income tax incentives for investment. Tax laws are often not clearly written and may be subjected to frequent revision, which makes long-term planning difficult for businesses. Each incentive has a range of extensive conditions to be met as tax authorities out into place anti-avoidance measures to prevent tax leakage. This complexity imposes risk on the taxpayers.

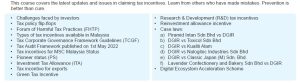

COURSE OUTLINE

PROFILE(s)

Yong Mei Sim has served over 35 years in the Inland Revenue Board of Malaysia (“IRB”) and held the last position as the Principal Assistant Director of the Penang branch, before retiring in 2016. She obtained a Bachelor of Science Degree majoring in Economics with a Second Class Upper from the University Science of Malaysia in Penang. She was later awarded the prestigious JPA scholarship to pursue and successfully completed her Master’s of Science in Taxation from the Golden Gate University in San Francisco, USA. During her tenure in office, she has been, inter alia, an audit manager in charge of the Payroll Taxes Unit, Field Audit and Desk Audit Unit. She had actively assisted the Federal Councils of the IRB in handling tax litigation cases. Among the landmark tax litigation cases which she was directly involved are ICTSB vs DGIR, PSSB vs DGIR and Marigold (M) Sdn Bhd vs DGIR. With her vast knowledge and experience in the field of Malaysian taxation, she has been invited by the IRB and other professional bodies to speak extensively around the country and to share her valuable experience and expertise on income tax updates and all other relevant taxation matters.