CPD EVENTS

- This event has passed.

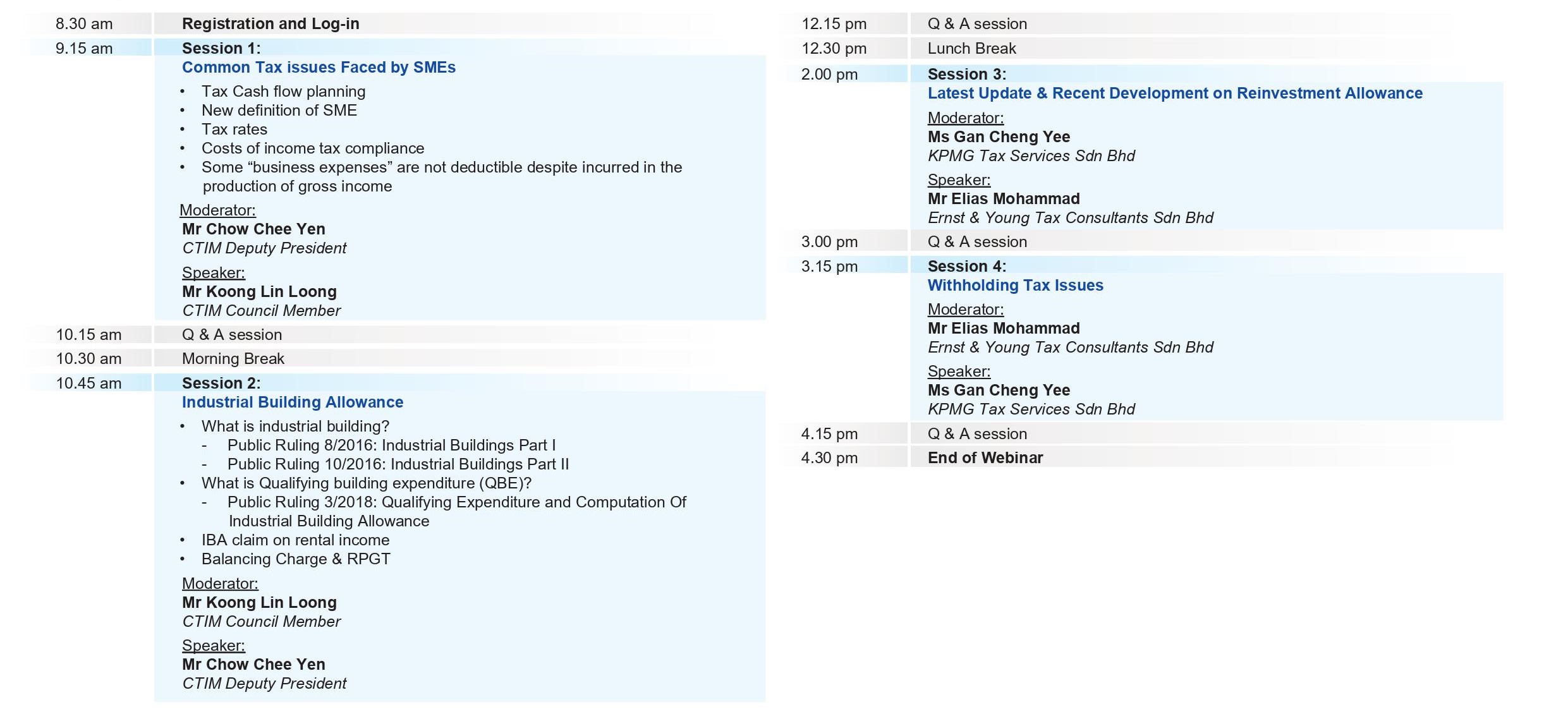

COURSE OUTLINE

PROFILE(s)

Chow Chee Yen is currently the Senior Executive Director of Grant Thornton Malaysia. He has more than 30 years of tax experience and was involved in tax engagements concerning cross border transactions, tax due diligence review, restructuring schemes, corporate tax planning, group tax review, inbound investments and good and services tax (GST). Chee Yen’s expertise is in high demand and he is a prolific trainer/facilitator for tax workshops and seminars organised by professional bodies in Malaysia. In addition, he conducts in-house training for government ministry, professional firms and corporations as well as guest speaker for national and international conferences. He is the Deputy President of the Chartered Tax Institute of Malaysia (FCTIM), a Fellow Member of The Association of Chartered Certified Accountants (FCCA) and a Chartered Accountant of the Malaysian Institute of Accountants (CA). He is also a graduate of the Malaysian Institute of Certified Public Accountants (MICPA) Examinations.

Gan Cheng Yee is currently a Tax Manager at KPMG Tax Services Sdn Bhd and has over seven years of working experience in tax practice. Her experience covers both corporate tax compliance and tax advisory engagements. She serves local and multinational companies from various industries such as property development, construction, oil and gas, investment holding, education, pharmaceutical, trading, manufacturing, etc. She is involved in engagements on withholding tax implications arising from cross-border transactions and international tax planning exercises. Apart from that, she has also assisted clients on tax due diligence, group restructuring, feasibility study of tax incentives, permanent establishment, real property gains tax and stamp duty. She is a member of CPA Australia and CTIM.

Elias Mohammad is a Tax Senior Manager at Ernst & Young Tax Consultants Sdn Bhd and has over 10 years of experience in business tax compliance services and tax advisory services. He has been involved in a series of tax engagements relating to tax retainer service, tax planning and restructuring of operations of companies to achieve a tax efficient group structure, advising on real property gains tax and stamp duty exemption. Assisted clients with transfer pricing planning and transfer pricing documentations. Elias has lectured extensively in the Firm’s professional development programmes and universities throughout Malaysia, as well as for clients and in public seminars regarding tax matters. Involved in Goods and Services Tax (GST) implementation projects for companies in various industries. Liaising and meeting with the regulatory body on behalf of clients on tax matters such as tax audit, tax appeal on withholding tax returns, withholding tax refund and revision of prior years’ tax returns. Provide consultation services on Malaysian Withholding Tax for cross-border transactions for payments of royalty, interest, dividend, special classes of income including determination of Permanent Establishment status for project teams which are to be located in Malaysia. Assisted clients with computation of tax provisioning for the purpose of statutory account.

Koong Lin Loong has been actively involved in various commerce and community services. He is currently the Council Member of Chartered Tax Institute of Malaysia (CTIM), Chairman of its Membership Committee, National Council Member of the Associated Chinese Chambers of Commerce and Industry of Malaysia (ACCCIM), Chairman of ACCCIM SMEs Committee and Taxation Taskforce and ACCCIM Representative to SST Technical Committee, Royal Malaysia Customs. In addition, Mr Koong is regular speaker, moderator and commentator of Tax, GST and SMEs forums and roundtable discussions by Professional and Trade Associations.