CPD EVENTS

- This event has passed.

INTRODUCTION

Public Rulings and Tax Guidelines are vibrant developments undertaken by the Inland Revenue Board to educate the public on amendments to Tax Laws and Procedure, especially those of substantial impact. In line with this objective, Revenue would occasionally also issue tax guidelines to assist the taxpayer in proper compliance. The Rulings selected for this seminar are those that relate to current issues that might pose difficulty in understanding or matters that are more commonly encountered within the responsibilities of tax consultants, professionals, and company officials. To achieve this and to offer further insights into the respective topic, the Public Rulings will be supported by examples and computations.

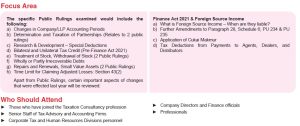

COURSE OUTLINE

PROFILE(s)

Vincent Josef began his career with the Inland Revenue Board in 1968 and over the next 35 years, he served in various Branches. Prior to his retirement, he was with the Operations Division of the Board Headquarters where he held the position of Assistant Director General. In addition, He has wide experience in lecturing at IRB events and Malaysian professional institutions including Chartered Tax Institute of Malaysia, Malaysian Institute of Accountants, CPA Australia, MAICSA and Commerce Clearing House (CCH) Malaysia. With his 50 years’ experience in the field of taxation, he also manages his own practice providing taxation consultancy services focusing on Tax Audits and Investigations. He has written a book “Tax Audit and Investigation Guide – Malaysia” published by CCH Malaysia and served as their Consultant Editor in respect of the Malaysian Master Tax Guide.