CPD EVENTS

- This event has passed.

COURSE OUTLINE

DAY 1, 27 July 2021, Tuesday

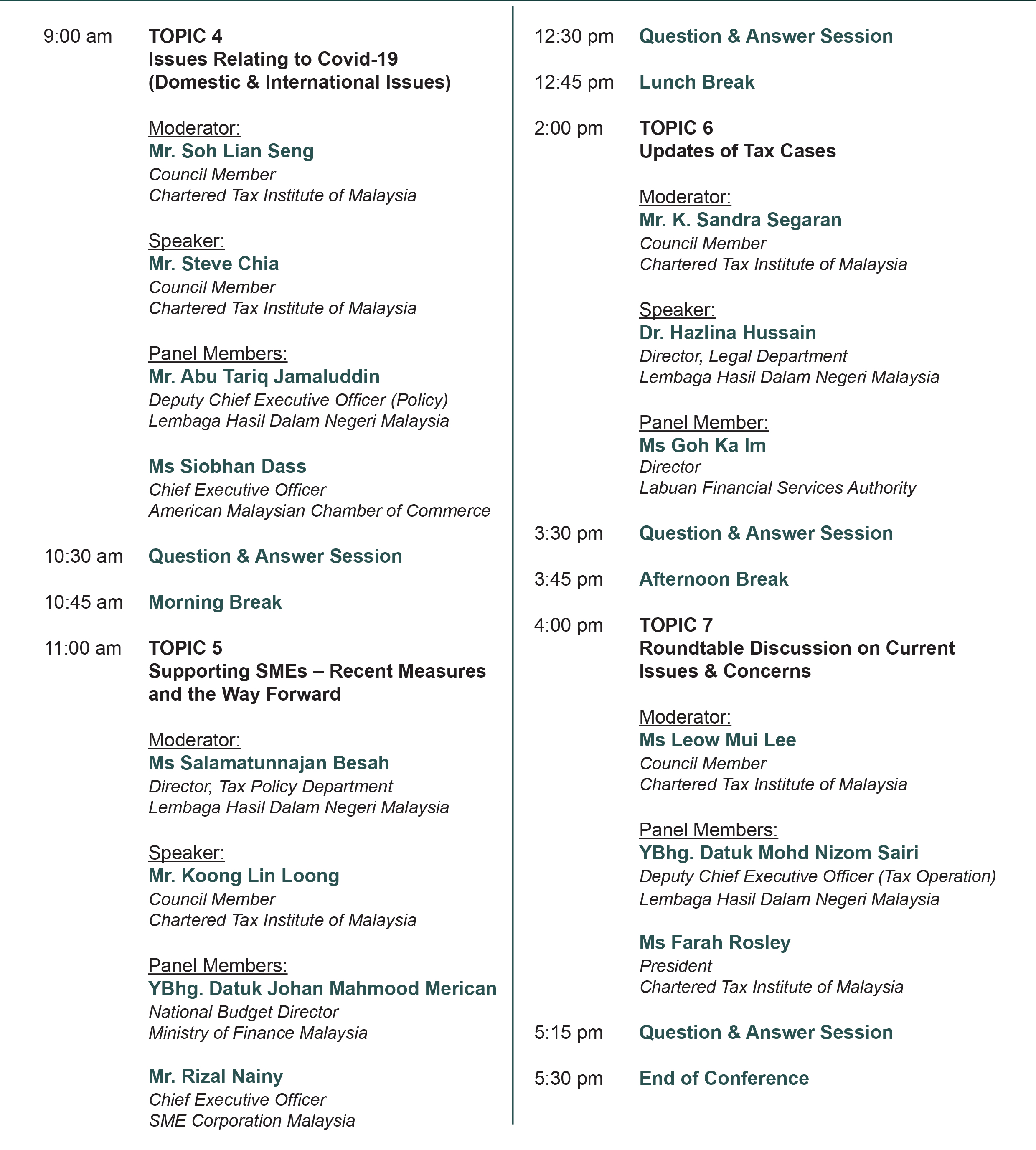

DAY 2, 28 July 2021, Wednesday

PROFILE(s)

Dato’ Sri Dr. Sabin Samitah was appointed as the Chief Executive Officer of IRBM in December 2016. He has served in senior capacities in all the core functions of the tax administration for over more than 30 years. Dato’ Sri Dr. Sabin Samitah served 15 years as an Investigation Officer before assuming the position of Director of Investigation Department. He has also held numerous managerial posts including Director of the Large Taxpayers Branch as well as State Director of the Federal Territory of Kuala Lumpur. Prior to his appointment as Chief Executive Officer, he held the position of Deputy CEO (Management) and Deputy CEO (Tax Operations). Dato’ Sri Dr. Sabin Samitah holds a Doctorate in Management from Universiti Utara Malaysia as well as Certificate in Senior Leadership from the Razak School of Government in collaboration with the University of Oxford and also from Harvard Business School. He is currently a Fellow Member of the Chartered Tax Institute of Malaysia.

Datuk Mohd Nizom Sairi is currently the Deputy Chief Executive Officer (Tax Operations), IRBM spearheading cross functional team which include Tax Operation, Revenue Collection, Information Technology, Corporate Services as well as Real Property Gains Tax (RPGT) and Stamp Operation. He has been with IRBM for over 35 years serving in various capacities. Having progressive experience in numerous fields of directorship, he started as a Collection Branch Kuala Lumpur Director before assuming the role as a Compliance Department Director. He then became the State Director of Perak, and later was assigned to head the Malaysian Tax Academy before being appointed as the Investigation Department Director. Prior to his current position, he was given the task as the Deputy Chief Executive Officer (Management). Complementing his vast background, he has presented at several local and international events speaking on topics relating to taxation, management and leadership.

Abu Tariq Jamaluddin is currently the Deputy Chief Executive Officer (Policy) of IRBM He has over 25 years of experience in advisory, litigation and drafting work in all aspects of tax and revenue law and has represented the Director General of Inland Revenue before the Special Commissioners of Income Tax and at all levels of the Malaysian Courts in many landmark tax cases. Abu Tariq was formerly the Chairman of the Dispute Resolution Panel, an initiative introduced by the IRBM to expedite tax appeals by tax payers which has received recognition from IMF, via TADAT (Tax Administration, Diagnostic Assessment Tool) Evaluators. He has also been a permanent member of IRBM’s Drafting Committee since 1997 and a regular presenter on tax cases at Malaysia’s annual National Tax Conference as well as various national and international conferences and seminars on taxation.

Salamatunnajan Besah started her career at the IRBM in 1985 as an Assessment Officer at the Assessment Branch in Jalan Duta and held various positions such as the Director of International Taxation, Director of Multinational Branch, Director of Mutual Agreement Procedure & Transfer Pricing Policy Division. She was involved in the WP6 Meeting OECD, Paris and the Asia-Pacific Regional Network meeting on BEPS Project. She graduated with a Bachelor of Business Economics degree from Brock University, Canada and MBA from Universiti Kebangsaan Malaysia. She currently holds the position of the Director of Tax Policy Department.

Dr. Hazlina Hussain is currently the Director of the Legal Department, IRBM. She holds a Doctorate degree in Management from Universiti Utara Malaysia and a Law degree from International Islamic University. She joined IRBM in 1996 and has a 24 years of experience in legal area. She is a member of annual Budget Drafting Committee and as the IRBM Head of Revenue Solicitors. Dr. Hazlina served as the Panelist in the 10th Annual ASEAN Tax Conference 2019 in Bangkok, Thailand. Her recent achievements include Landmark case of Bintulu Lumber Development Sdn Bhd at Federal Court, Sumurwang Development Sdn Bhd at Court of Appeal, Sumur Heights Sdn Bhd at Court of Appeal, Top Capital Sdn Bhd at Court of Appeal, Continental Choice Sdn Bhd & CB Ventures SB at Court of Appeal and a lot more to name it.

Dr. Esther A.P. Koisin is the Director of the Department of International Taxation, IRBM. She has been involved in international taxation for many years and has served as Deputy Director of the Treaty Division, Director of MAP Division and Director of International Affairs and Exchange of Information Division. She has also served as the Deputy Director of the International Training Centre of the Malaysian Tax Academy. She is currently the Deputy Chair of the IRBM Digital Economy Taskforce and Malaysia’s country delegate to the OECD Task Force on the Digital Economy. She holds a Doctorate degree from Universiti Utara Malaysia, an Economics degree from University of Malaya and a Law degree from University of London.

Farah Rosley is the Malaysia Tax Markets Leader of Ernst & Young Tax Consultants Sdn Bhd. She has more than 20 years of experience handling tax consulting and advisory including tax structuring, tax reviews, incentives, tax audits and investigations and transfer pricing assignments, covering a range of industry sectors. Farah has worked closely with government authorities and agencies on various taxation matters for local and multinational corporations. She also has had engagements at government consultation meetings and been invited to attend task force on tax policy matters. Farah is currently the President and Fellow member of CTIM.

Yeo Eng Ping is the EY Asia-Pacific Tax Leader. Prior to assuming her current role, Eng Ping led Tax in the ASEAN region and has broad experience in advising clients on transactions across a number of sectors, including real estate and oil and gas. A lawyer by training, Eng has a strong interest in the development of taxation policy and controversy. Eng Ping is an Advocate and Solicitor of the High Court of Malaysia; Barrister and Solicitor of the Supreme Court of Victoria, Australia ; Council Member of the CTIM; and a Fellow of Certified Practicing Accountants Australia .

Leow Mui Lee is the Senior Executive Director of Tricor Taxand Sdn Bhd. She is a Council Member of CTIM as well as a member of CPA Australia and the MIA. Mui Lee has many years of tax experience with leading international accounting firms in Malaysia. She leads Taxand’s transfer pricing service line and has serviced a broad spectrum of clients including large multinational corporations and public listed companies. She has also managed projects relating to tax audits & investigations, tax risk management as well as tax due diligence. Under Mui Lee’s stewardship, Taxand has won numerous awards.

K Sandra Segaran is currently General Manager (Group Tax) in Petronas. Prior to joining Petronas, he was an Executive Director in a Big-4 accounting firm where he served 8 years, including a stint of 3 years as head of International Tax in the Malaysian practice. He started his career in taxation in the Inland Revenue Board, where he served 22 years. Segaran’s over 30 years of tax experience covers a wide range of industries and legislation relating to all matters of Malaysian taxation. Segaran is a Council Member of CTIM.

Koong Lin Loong has been actively involved in various commerce and community services. He is currently the Council Member of CTIM, Chairman of its Membership Committee, National Council Member of the Associated Chinese Chambers of Commerce and Industry of Malaysia (ACCCIM), Chairman of ACCCIM SMEs Committee and Taxation Taskforce and ACCCIM Representative to SST Technical Committee, Royal Malaysia Customs. In addition, Mr Koong is regular speaker, moderator and commentator of Tax, GST and SMEs forums and roundtable discussions by Professional and Trade Associations.

Soh Lian Seng leads the Tax Dispute Resolution practice at KPMG in Malaysia, and brings over 25 years of experience advising local and multinational corporations on tax advisory and compliance, specialising on tax audit and investigations across different sectors. His negotiation skills and problem solving acumen are well recognised by clients, supported by the numerous resolved cases Lian Seng has secured in major dispute resolution engagements. Lian Seng is the firm’s Head of Korea Business Practice and leads the Capital Allowances Review Team at KPMG in Malaysia. He is a Council Member of CTIM and Chairman of its audits and investigations working group.

Thenesh Kannaa is a partner at TraTax whom advises on both international tax and indirect tax matters to clients from diverse industries including manufacturing, services, distribution, retail, construction, property development, healthcare, financial services, shipping, automotive, telecommunications, societies, GLCs and statutory bodies. Thenesh is a Council Member of CTIM, chair of Technical Committee on Direct Tax I and member of other technical committees. He is also a member of ACCA’s expert panel on taxation, member of Industry Advisory Panel for Taylor’s School of Professional Studies and an exco member of the International Fiscal Association’s Malaysian branch. Thenesh is also the author of various books and articles on taxation.

Steve Chia is a Council Member of CTIM and a Fellow of the Chartered Association of Certified Accountants (UK). He has over 22 years of experience within the tax practice and has undertaken high value tax and business consulting projects for local conglomerates as well as multinational clients in various industries including property, infrastructure, logistics, manufacturing, trading, construction, as well as education. He has conducted client workshops and seminars on taxation matters as well as currently, a tax examiner for a leading UK professional body. Steve is a Tax Partner of PricewaterhouseCoopers Taxation services Sdn. Bhd.

Anil Kumar Puri has over 20 years of tax compliance and consulting experience and leads EY Malaysia’s International Corporate Tax Advisory and Tax Technical teams. He has advised on the tax and regulatory issues of many cross-border transactions (both inbound and outbound). His experience includes advising on the impact of the OECD’s Base Erosion & Profit Shifting Action Plans on holding and transactional structures, regulatory approvals, withholding taxes, tax incentives, structuring of operations in a business-focused and tax efficient manner and exit strategies. Anil has advised on a number of restructuring exercises, including pre-IPO restructuring and pre-divestment restructuring. He has also led various tax buy-side and sell-side due diligence projects, including multi-country projects, involving various industries such as retail, education, oil & gas and healthcare. Anil regularly speaks at tax conferences and training sessions, including on BEPS 2.0 and digital tax matters.

Datuk Johan Mahmood Merican is Director of the National Budget Office at the Ministry of Finance. He was previously the CEO of Talent Corporation Malaysia Berhad (TalentCorp) and the Principal Private Secretary to the Minister in the Prime Minister’s Department and the Ministry of Finance. He has 20 years experience in policy development, corporate finance and accountancy in Malaysia as well as in UK. He is a trained chartered accountant and an Associate of the Institute of Chartered Accountants in England and Wales (ICAEW) Mara (UiTM).

Dr. Afzanizam is currently the Chief Economist of Bank Islam Malaysia Berhad. With 19 years of experience in investment research, especially in the field of economics and capital market, he had served various investment institutions such as Khazanah Nasional Berhad, Retirement Fund Incorporated and rating agencies like Malaysian Rating Corporation Berhad as an economist. Since joining Bank Islam on 1 October 2013, Dr. Afzanizam plays a vital role in advising the Bank on matters regarding macroeconomics such as fiscal and monetary policies that can affect the operating environment of various industries. Dr. Afzanizam holds a Doctor of Philosophy (Economics) and Master of Business Administration (MBA) (Applied Finance and Investment) degree from Universiti Kebangsaan Malaysia (UKM), as well as Bachelor of Business Administration (Hons) Finance and Diploma in Investment Analysis degree from Universiti Teknologi Mara (UiTM).

Dr. Jomo Kwame Sundaram is a Fellow at the Academy of Science, Malaysia, a Senior Adviser at the Khazanah Research Institute, Visiting Fellow at the Initiative for Policy Dialogue, Columbia University and Adjunct Professor at the International Islamic University, Malaysia. He was Professor at the University of Malaya (1986 – 2004), Founder-Chair of International Development Economics Associates (IDEAs), UN Assistant Secretary General for Economic Development (2005 – 2012), Research Coordinator for the G24 Intergovernmental Group on International Monetary Affairs and Development (2006 – 2012), and Assistant Director General for Economic and Social Development, Food and Agriculture Organization (FAO) of the United Nations (2012 – 2015). He received the 2007 Wassily Leontief Prize for Advancing the Frontiers of Economic Thought.

Dr. Juita Mohamad is a Fellow in the Economics, Trade and Regional Integration (ETRI) Division of ISIS Malaysia. Previously, she has worked at the Asia Desk, OECD in Paris, at ISIS Malaysia, the Asian Development Bank Institute and Waseda University in Tokyo, Japan. She holds a Ph.D. in International Studies from Waseda University, Japan. Her research focused on the impact of trade liberalisation on wage inequality between skilled and unskilled workers in Malaysia. She obtained her Master’s Degree in Economics from Shiga University, Japan and her Bachelor’s Degree in Business Administration from UKM. Her research interests include trade, regional integration, protectionism, wage inequality and the informal sector.

Goh Ka Im was a partner and the Head of the Tax and Revenue Practice Group as well as the Head of the Private Wealth and Family Business Practice Group of Shearn Delamore & Co until her retirement at the end of 2020. Ms. Goh who became a partner of Shearn Delamore & Co in 1997, has an LL.B (Hons) degree from the University of Bristol, UK and was called to the Bar of England and Wales as a member of Gray’s Inn. She was admitted as an advocate and solicitor of the High Court of Malaya in 1988 and the Supreme Court of Singapore in 1994. During her 33 years in Shearn Dealamore & Co, Ms. Goh handled many tax and revenue cases before the Special Commissioners of Income Tax, the High Court, the Court of Appeal and the Federal Court. Ms. Goh was also previously the Jurisdiction Editor of Malaysia (Labuan) for the International Tax Planning Association (ITPA) and the Chair of the Tax Committee of the Inter Pacific Bar Association (IPBA) Ms. Goh is currently a Member of the Labuan Financial Services Authority.

Rizal Nainy is currently the Chief Executive Officer for SME Corporation Malaysia. One of his primary responsibilities is to plan, implement, monitor and value-add strategic SME development programmes aligning with the 12th Malaysian Plan, National Entrepreneurship Policy 2030 and Shared Prosperity Vision 2030. Prior to joining SME Corporation Malaysia, Rizal has six years of strategic transformation experience under the Prime Minister’s Department to strategise and drive the National as well as State Government and Economic transformation programmes. He has also 16 years of varied experience with Shell Company locally and globally, and held various positions. Rizal has vast experience in business development, entrepreneurship, business advisory, economics and policy, international cooperation, coordination of SME programmes, 4th Industry Revolution, SME digitalisation and e-Commerce. Rizal graduated from Imperial College, University of London in Mechanical Engineering with First Class Honours, and then obtained the Master Degree in Business Administration (MBA) from Charles Sturt University, Australia.

Sim Kwang Gek has more than 20 years of experience in providing tax and business consulting services for local and multi-national corporations in the manufacturing, construction, engineering, property development, retail, information technology and services industry. She has led various assignments such as restructuring of operations, mergers and acquisitions, incentive evaluation and applications, regulatory applications to various government agencies, establishment of businesses in Malaysia, cross-border investments as well as managing the tax compliance affairs of a portfolio of clients. Kwang Gek holds a Bachelor of Accounting from the University of Malaya and is a member of the CTIM. She is also a Chartered Accountant of the MIA and a member of the MICPA.

Siobhan Das joined the American Malaysian Chamber of Commerce (AmCham Malaysia) as its Executive Director in 2016 and was promoted in 2020 to become the organization’s first Chief Executive Officer in its 43 year history. Siobhan has organisation’s an action-oriented policy platform at the Chamber that is designed to address both the strategic concerns of American multinational companies and the tactical day to day challenges faced by operations on the ground. Siobhan plays an active role in the 28-member strong AmChams of Asia Pacific (AAP), serving in the past year as a Vice Chair. She also serves on local boards: Junior Achievement Malaysia, focused on delivering education programs to school aged children in areas like financial literacy and entrepreneurship, and Global Shepherds, an NGO that provides care, welfare and intervention to those in poverty, victims of gender based violence and other forms of abuse, neglect and exploitation.