« All Events

Malaysian Property Tax, Estates and Trusts

REGISTRATION FEE (RM) The registration fees are exclusive of Service Tax

CTIM Member (23WS/040)

330

CTIM Student (23WS/040)

330

Members Firm Staff (23WS/040)

363

Closing Date | 11 August 2023

INTRODUCTION

This course covers many aspects of Malaysian tax law, regulations and public ruling. In particular, it covers the Real Property Gains Tax, Tax Treatment of Income for real property, Investment Holding Company, Estates and Trusts.

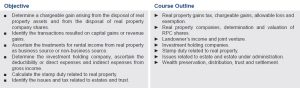

COURSE OUTLINE

PROFILE(s)

Dr. Tan Thai Soon is currently the Managing Director at TST Consulting Group and the Founder of Asian Institute of Knowledge Management. He has more than 20 years’ experience in management consulting and taxation matters. He provides consulting and training in taxation, company law, corporate governance, financial management, knowledge management and innovation. He has obtained substantial experience in management consultancy assignments while attached with an international consulting firm which include carried out feasibility study as special consultants, monitoring of housing projects, corporate recovery and receivership assignments. He has made contributions on articles to international and local journals, and national newspaper. He obtained his Doctor of Business Administration from University of Newcastle, Australia. He is a Fellow member of the CTIM, a Fellow member of MIM, and a member of MIPA. He is also an Approved Tax Agent, a Certified Financial Planner (CFP), a Registered Financial Planner (RFP) and a Registered Trust and Estate Practitioner (TEP).