CPD EVENTS

- This event has passed.

INTRODUCTION

Most sole -proprietors, partnerships and companies engaged tax agents to handle the preparation and submission of their company’s’ income tax returns but having the basic tax knowledge of tax-deductible expense in order to minimise any potential miscommunication between the companies and the tax agents is important. There are lots of rules around what can and cannot be claimed for business related expenses. To mitigate the risk exposure, it is important for taxpayers and tax agents to have sufficient basic tax knowledge to enable them to comply with the tax rules and current legislations.

By the end of this workshop, participants would be able to enhance the understanding of what business expenditure is tax deductible.

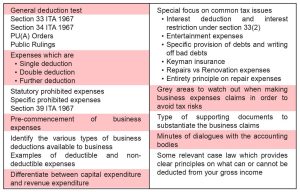

COURSE OUTLINE

PROFILE(s)

Yong Mei Sim has served over 35 years in the Inland Revenue Board of Malaysia (“IRB”) and held the last position as the Principal Assistant Director of the Penang branch, before retiring in 2016. She obtained a Bachelor of Science Degree majoring in Economics with a Second Class Upper from the University Science of Malaysia in Penang. She was later awarded the prestigious JPA scholarship to pursue and successfully completed her Master’s of Science in Taxation from the Golden Gate University in San Francisco, USA. During her tenure in office, she has been, inter alia, an audit manager in charge of the Payroll Taxes Unit, Field Audit and Desk Audit Unit. She had actively assisted the Federal Councils of the IRB in handling tax litigation cases. Among the landmark tax litigation cases which she was directly involved are ICTSB vs DGIR, PSSB vs DGIR and Marigold (M) Sdn Bhd vs DGIR. With her vast knowledge and experience in the field of Malaysian taxation, she has been invited by the IRB and other professional bodies to speak extensively around the country and to share her valuable experience and expertise on income tax updates and all other relevant taxation matters.