CPD EVENTS

- This event has passed.

COURSE OUTLINE

-

Tax leakages – Is everyone paying their fair share of taxes?

-

Global Minimum Tax (GMT)

-

Taxation of foreign source income in Malaysia – P.U.(A) 234 2022 & P.U.(A) 235 2022

-

Revised tax audit framework

-

Tax collection audit framework 2021

-

Tax refunds

-

Guidelines on Tax Treatment on the Income of Medical Practitioners in Private Hospitals

-

Guidelines on the tax treatment for developers or management bodies

-

New section 107D – Withholding on Malaysian tax residents

-

Deferment of payment of small-value withholding tax

-

IRB’s response to filing of Forms CP 22 / CP 22A

-

Latest tax cases

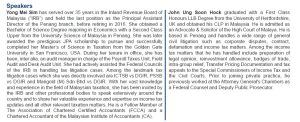

PROFILE(s)