« All Events

Business Tax – For Beginners

REGISTRATION FEE (RM) The registration fees are exclusive of Service Tax

CTIM Member (23WS/024)

330

CTIM Student (23WS/024)

330

Members Firm Staff (23WS/024)

363

Closing Date | 23 May 2023

INTRODUCTION

The preparation of the tax computation is the most fundamental skill possessed by a tax practitioner. It is the art of reconciling the Income Statement, which is prepared based on Financial Accounting conventions, to align with the provisions of the Income Tax Act, 1967.

This course aims to build a strong foundation on the fundamentals of tax computation for those who aspire a career as a tax practitioner.

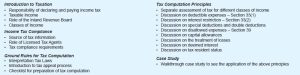

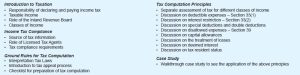

COURSE OUTLINE

PROFILE(s)

Jesudason Arulsamy has over 10 years of experience in the area of taxation including tax compliance, tax advisory, tax audit, and tax investigations, and has advised many local and international clients on taxation and other business compliance matters. Prior to his experience in the field of taxation, he had over 10 years of experience as a lecturer for professional courses such as ACCA, CAT, and LCCI. He also has audit experience in one of the Big 4 Audit Firms as well as experience in Company Secretarial compliance matters. Jesu is currently the Tax Partner of Dason & Dason Corporate Advisors Sdn Bhd. He is also the Chairman of the Southern Branch of the Chartered Tax Institute of Malaysia and a Committee Member of the CTIM Tax Audit and Investigation Working Group and Public Practice Committee. Prior to that, he used to serve as a Committee Member in the Malaysian Institute of Accountants – Johor Regional Committee between July 2014 to June 2017.