CPD EVENTS

- This event has passed.

INTRODUCTION

Malaysia’s Investment Incentives Initiative has two related objectives – to boost the national economy and secondly, to encourage businesses to expand their operations to enjoy benefits without additional expenditure being incurred. These incentives could be time or performance based, or founded on capital commitment which may also qualify for other reliefs. This Seminar is presented from the practical approach using several examples and computations and examines the various facets towards enjoying these incentives, from Qualification to Application to Utilization.

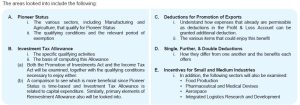

COURSE OUTLINE

PROFILE(s)

Vincent Josef began his career with the Inland Revenue Board in 1968 and over the next 35 years, he served in various Branches. Prior to his retirement, he was with the Operations Division of the Board Headquarters where he held the position of Assistant Director General. In addition, He has wide experience in lecturing at IRB events and Malaysian professional institutions including Chartered Tax Institute of Malaysia, Malaysian Institute of Accountants, CPA Australia, MAICSA and Commerce Clearing House (CCH) Malaysia. With his 54 years’ experience in the field of taxation, he also manages his own practice providing taxation consultancy services focusing on

Tax Audits and Investigations. He has written a book “Tax Audit and Investigation Guide – Malaysia” published by CCH Malaysia and served as their Consultant Editor in respect of the Malaysian Master Tax Guide.